Interested in our services?

At PDR CPAs, we leverage our 50 years of industry expertise to help you keep your finances strong and your business moving forward.

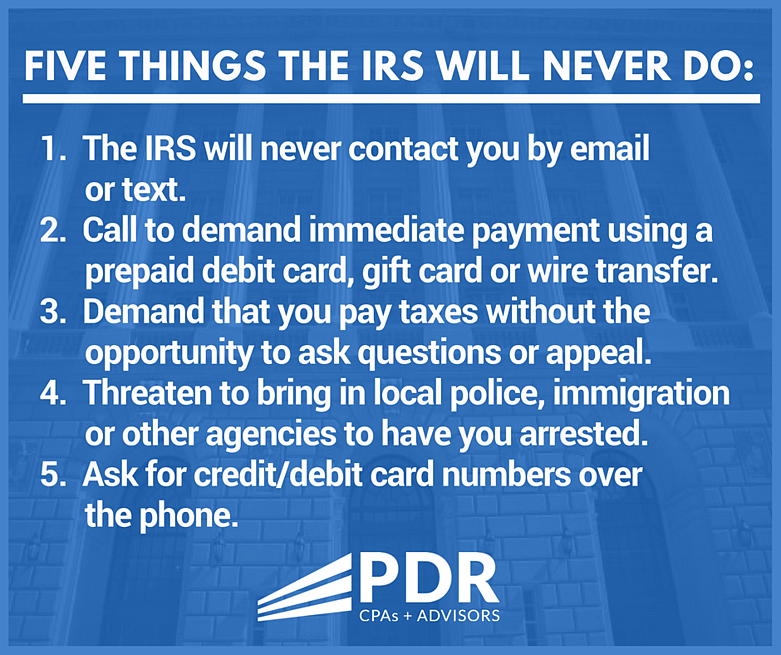

Thousands of people have lost millions of dollars and their personal information to tax scams. Scammers use the regular mail, telephone, or email to set up individuals, businesses, payroll and tax professionals.

A sophisticated phone scam targeting taxpayers, including recent immigrants, has been making the rounds throughout the country. Callers claim to be IRS employees, using fake names and bogus IRS identification badge numbers. They may know a lot about their targets, and they usually alter the caller ID to make it look like the IRS is calling.

Victims are told they owe money to the IRS and it must be paid promptly through a gift card or wire transfer. Victims may be threatened with arrest, deportation or suspension of a business or driver’s license. In many cases, the caller becomes hostile and insulting. Victims may be told they have a refund due to try to trick them into sharing private information. If the phone isn’t answered, the scammers often leave an “urgent” callback request.

The IRS doesn’t initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information.

The IRS initiates most contacts through regular mail delivered by the United States Postal Service. However, there are special circumstances in which the IRS will call or come to a home or business, such as when a taxpayer has an overdue tax bill, to secure a delinquent tax return or a delinquent employment tax payment, or to tour a business as part of an audit or during criminal investigations. Even then, taxpayers will generally first receive several letters (called “notices”) from the IRS in the mail.

Many taxpayers have encountered individuals impersonating IRS officials – in person, over the telephone and via email. Don’t get scammed. We want you to understand how and when the IRS contacts taxpayers and help you determine whether a contact you may have received is truly from an IRS employee.

Additional information about tax scams are available on IRS social media sites, including YouTube and Tumblr where people can search “scam” to find all the scam-related posts. You can also review the following articles:

Please feel free to reach out to your PDR Tax Advisor if you have a question about communication from the IRS, or anyone claiming to represent the IRS.

Sign up for industry accounting and tax tips below

At PDR CPAs, we leverage our 50 years of industry expertise to help you keep your finances strong and your business moving forward.