Interested in our services?

At PDR CPAs, we leverage our 50 years of industry expertise to help you keep your finances strong and your business moving forward.

Not-for-profit financial statement development to support those who support the community

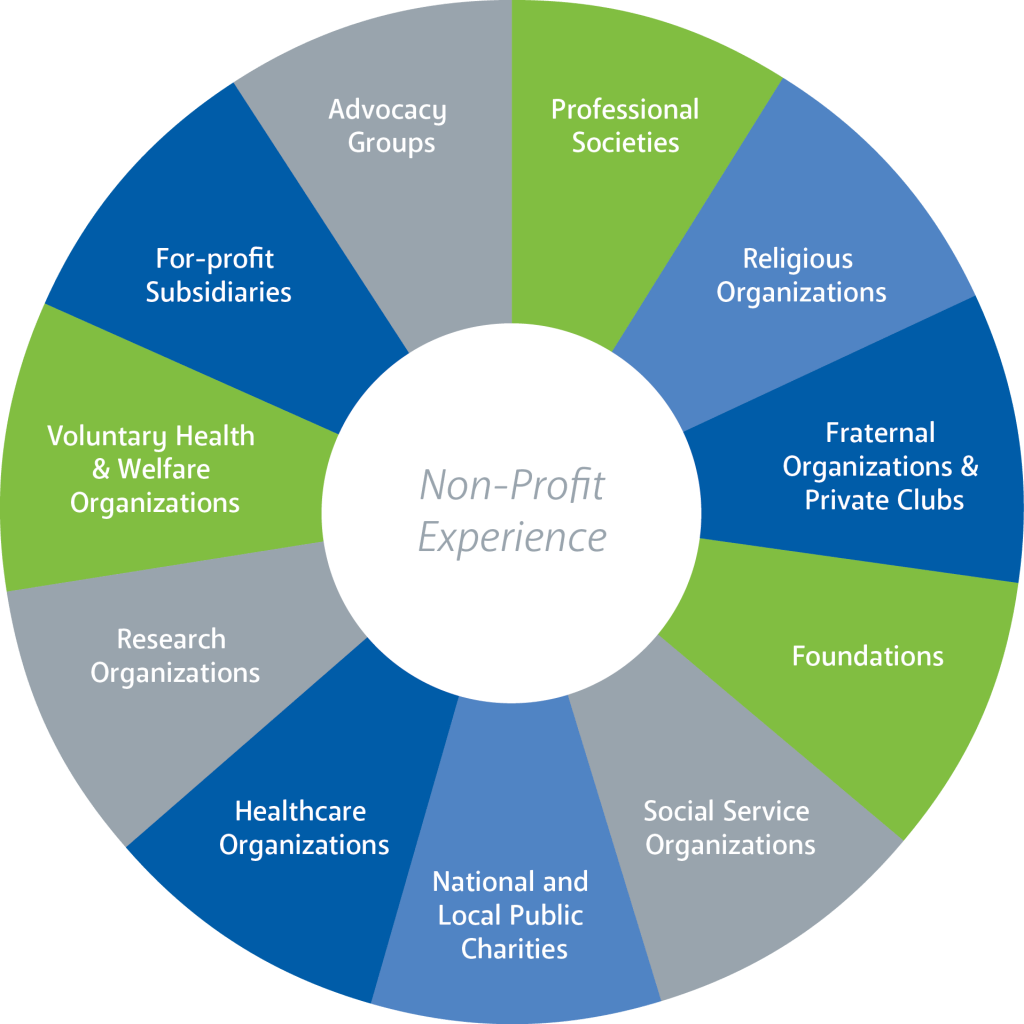

We take great pride in our community and have a great deal of respect for those dedicated to serving it. We dedicate substantial resources to helping not-for-profit organizations achieve their mission. At PDR, we understand the commitment and values that drive not-for-profit organizations and help implement solutions that answer the unique needs of the tax-exempt sector. From not-for-profit financial statements to asset and liability accounting, our goal is to help these organizations maximize charitable tax dollars so that they can help our community thrive.

Sign up for industry accounting and tax tips below

At PDR CPAs, we leverage our 50 years of industry expertise to help you keep your finances strong and your business moving forward.