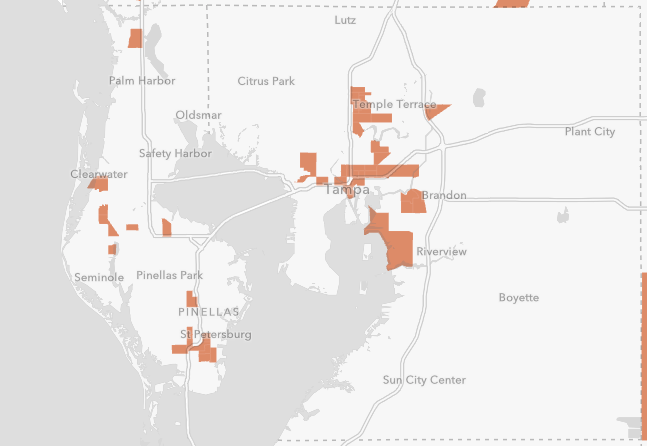

Opportunity Zones in the Tampa Area

In 2017, Congress established a new community development program called “Opportunity Zones” within the Tax Cuts and Jobs Act of 2017. This program was founded to encourage long-term investments in low-income urban and rural communities through the United States.

Individuals and businesses with capital gains can qualify for this program. The goal is to make funds accessible to both large investments and low-income communities. Below, we list three tax benefits for investing in low-income communities through a qualified opportunity fund:

1. Temporary Deferral

Investors can place existing assets with accumulated capital gains into Opportunity Funds. The deferred gain must be recognized on the earlier of the date on which the opportunity zone investment is disposed of or until the end of 2026.

2. Tax Impact

Capital gains that have been placed in an Opportunity Fund for 5 years will receive a 10 percent tax reduction on the gain. An additional 5 percent reduction in tax will apply if the capital gains are held for 7 years.

3. Permanent Exclusion

Investors will pay no taxes on any capital gains produced through their investment in Opportunity Funds for investments that are held for at least 10 years. The permanent deferral is for the portion of the gain that was originally placed into the Opportunity Fund.

Projects that Opportunity Zones Support

Opportunity Funds can finance multiple activities and projects including real estate, housing, infrastructure, and existing or start-up businesses. However, not every real estate project will qualify for Opportunity Fund financing. There will need to be significant improvements in the properties for the investment to qualify for Opportunity Fund financing.

Which Communities Are Opportunity Zones?

Currently, there are 8,762 US census tracts that are Opportunity Zones. The zones were nominated by the governors of 50 states and 4 territories. These opportunity zones are said to not be changing anytime soon.

Below, we’ve provided a map of Opportunity Zones in the Tampa Area.

Work with PDR CPAs

If you are interested in a prosperous future from a personal and/or business standpoint, reach out to our team of dedicated specialists. When considering accounting, audits, tax or business consulting, one call can make all the difference. Click here to get started – we look forward to working with you!