It’s difficult for many people to write off medical expenses because of the limits imposed under the tax laws. But you may qualify by including every expense allowed. Some of the qualified procedures may surprise you.

For example, most insurance plans won’t cover laser eye surgery, such as radial keratotomy or “Lasik,” because they consider it a cosmetic procedure. But it generally qualifies for a medical deduction and as an expense in a flexible spending account. (The IRS used to disallow Lasik as a deductible medical expense.) With the cost running into the thousands in most parts of the country, it’s a considerable outlay.

As with most tax laws, the medical rules can be tricky. You can’t deduct over-the-counter vitamins but the U.S. Tax Court has ruled that medically prescribed vitamins to treat a specific condition are allowed.

There are also many exceptions to the general laws. For instance, you can’t write off the cost of unnecessary cosmetic surgery to improve your appearance. That generally means no face lifts, electrolysis or liposuction. But you can deduct cosmetic surgery that’s needed to improve a deformity directly related to a congenital abnormality, an injury from an accident, or a disfiguring disease.

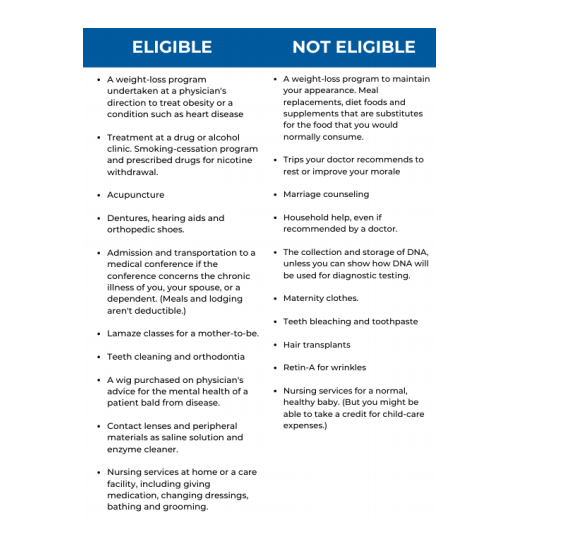

A list of some other expenses that are eligible or ineligible for tax breaks appears in the right-hand chart.

Here’s a rundown of the basic rules:

Flexible spending accounts (FSAs). These tax-advantaged accounts generally have a “use-it-or-lose-it” feature on money left at the end of the year. So plan to empty your account by buying eyeglasses, filling prescriptions, getting a dental checkup or spending money on the eligible items listed in the chart. Note: Some FSAs allow participants an extra two-and-a-half-month grace period to use up the money in accounts if the employer properly amends its plan.

Medical deduction. Medical and dental expenses that are not reimbursed by insurance are deductible to the extent your annual total exceeds 7.5% of your adjusted gross income in 2020 (unchanged from 2019). This can be a difficult threshold for many taxpayers to meet. To qualify for medical deductions, you must also itemize.

When adding up your medical costs, don’t forget the cost of traveling to your doctor or medical facility for treatment. If you go by car, you can deduct a flat rate, adjusted by the IRS each year, or you can keep track of your actual out-of pocket expenses for gas, oil and repairs.

With either the actual costs or the cents-per-mile method, you can add in the amounts paid for parking and tolls. If you must travel out of town for medical treatment, you may also qualify to write off some of the cost.

Each year, take a look at your medical expenses. If you are close to — or exceed the threshold — you may want to get as many expenses as possible into this year. Otherwise, you may as well postpone elective expenses until next year when you have another shot at a deduction.